- May 14, 2020

- Posted by: admin

- Category: Forex Trading

Contents:

Harmonic Patterns are trend reversal patterns especially for the traders who want to master mean reversion aka trend reversal trade setups. Once the price prints two red consecutive candles after a series of green candles, the uptrend is exhausted and the reversal is likely. My favourite would be a simple Stochastic Oscillator with settings . The reversal pattern is valid if two of the candles are fully completed on daily charts as per GBPJPY screenshot below.

By submitting this form I authorize Fincash.com to call/SMS/email me about its products and I accept the terms of Privacy Policy and Terms & Conditions. The current bar’s low, the current Heiken Ashi open, and the current Heiken Ashi close is used to calculate the low. The greatest of the current bar’s high, the current Heiken Ashi open, and the current Heiken Ashi close is high. In case you are looking to start trading and investments, let us assist you in taking the next steps forward. It is great for keeping you in an extended period of trade and visual simplicity. It makes many false signals and retracements disappear leaving you with solid calls taken into action.

Heikin Ashi candlestick is a unique charting method which gets attached to your standard price chart. It is important to note that Renko charts may not change for several time periods. Prices have to rise or fall significantly in order for bricks to be added. The Kagi line will continue to move up until prices reverse by a specified amount.

The shadows are the thin lines that extend out from either side of the fat part of the candle – called the real body. Upward trending moves typically have long upward candles with very little or no lower shadows. The HA candles change dramatically in appearance when a strong trending move is underway relative to pullbacks. Price Data sourced from NSE feed, price updates are near real-time, unless indicated. Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary.

Candlestick Patterns Explained

Twiggs money flow heiken ashi reversal patterns is nothing but a modified version of Chaikin Money Flow indicator. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Please note that by submitting the above-mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. We can immediately see how much more controlled and decisive trading becomes when a trading technique is used. There are no wild emotional rationalisation, every trade is based on a calculated reason. But recent economic indicators from China showed that certain facets of the country were still struggling to recover from the impact of the pandemic.

How accurate are Heiken Ashi candles?

Heikin-Ashi candlesticks are better deciphered than traditional candlestick charts hence its easier to identify market trends and movements. Reliability: Heikin-Ashi is a very reliable indicator, providing accurate results. It uses historical data, which is also quite dependable.

A new Heikin Ashi candle will form every period, but a new brick/box will only appear on a Renko chart once the price has moved a particular amount. It is one of the best reversal trading strategy that offers a better way to manage trades. Candles with a small body surrounded by upper and lower shadows show a change in trend. If you are a person likes to take a risk, you may buy or sell here. This is a multiple multi-timeframe version of famous supertrernd only with Heikin Ashi as source. Atr which stands in the heart of supertrend is calculated based on heikin-ashi bars which omits a great deal of noises.

What Does Heikin Ashi Tell?

A two-bar reversal, as the name suggests, is a reversal pattern that appears near the end of an uptrend or a downtrend. Both the bars should be long compared to the preceding bars and must preferably be accompanied by higher-than-usual volume. Heikin-Ashi charts help to smooth out market noise and depict price trends more clearly.

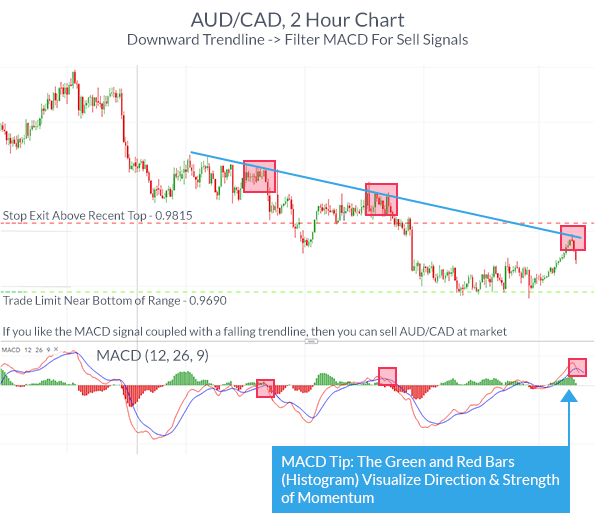

When combined with MACD crossover and divergence, MACD is a valuable trend and momentum indicator that offers obvious buy and sell signals. For more clarity, this indicator can also be used with other technical approaches. A divergence occurs when MACD projects highs or lows that exceed the corresponding highs and lows on the price.

What is the difference between Heiken Ashi and candlestick?

The MACD can be used for intraday trading with the default 12, 26, 9 settings. However, different traders may use different settings when trading with 5-minute, 15-minute, 30-minute, 1-hour, and daily charts. They suggest that price will continue moving in the same direction. A continuation pattern in a downtrend suggests that price will fall further. A continuation pattern in an uptrend indicates that price will continue to rally higher. Heikin-Ashi data is averaged; therefore, real prices are not depicted when the market is opened or closed.

- On the chart above; bullish candles are marked in green and bearish candles are marked in red.

- A stock that has been ranging for a long time frame may be represented with a single field, which doesn’t convey every little thing that went on throughout that point.

- Candles with long shadows and small bodies suggest a trend weakening or a trend reversal.

- Crossovers are very useful when conforming to the current trend.

OVERVIEW This indicator shows whether Heikin Ashi is up or down, represented by a bar. All I want to know is whether the commonly known technical analysis is ‘UP’ or ‘DOWN’. Heikin Ashi candles filter out most of the noise from liquidity sweeps and high volatility and give us a nice, normalized trend indication. When so many HA Candles follow in the opposite direction to the previous trend, it can be seen as a trend reversal. A simple modification of the Tradingview free script of futures Open Interest to Heikin Ashi candles.

Breakouts and Reversals

A Doji-like structure may show consolidation or a possible reversal of the trend.

The down days are represented by crammed candles, whereas the up days are represented by empty candles. These can also be colored in by the chart platform, so up days are white or inexperienced, and down days are pink or black, for instance. Renko charts do not show as much detail as candlestick or bar charts given their lack of reliance on time.

Candlestick Patterns : 6 most Reliable Candlestick Patterns

The readings drove up fears that the Fed will maintain its hawkish rhetoric and drive interest rates higher. Some patterns are referred to as bearish in that they suggest that price may fall. The Heiken-Ashi indicator can be used along with other technical indicators to provide strong market alerts. Based on the averages of two periods, Heikin-Ashi charts are created. Renko charts, on the other hand, are made by simply displaying small fluctuations. On the left side, you can see the red candles, and at the starting point of the decline mark, the lower wicks you can find in a very small size.

- Heikin-Ashi Doji and spinning tops can be used to spot reversals point in share.

- Candlesticks have become a staple of each buying and selling platform and charting program for literally every monetary buying and selling automobile.

- The second bar opens near the close of the previous bar, but then rallies sharply to close near the high.

- However, you’ll be able to take a look at changing the shifting averages with this indicator.

- It belongs to the household of candlestick charts and was imported to the West from Japan.

- It is one of the best reversal trading strategy that offers a better way to manage trades.

The quantity should be a minimum of two or extra instances bigger thttps://1investing.in/n the typical day by day buying and selling volume to have essentially the most impact. The bearish engulfing candle will actually open up larger giving longs hope for an additional climb because it initially indicates extra bullish sentiment. However, the sellers are available very strong and extreme trend driving down the price by way of the opening level, which begins to stir some issues with the longs. The selling intensifies into the candle close as almost every buyer from the prior close is now holding losses.

Stay in Strong Trends with the Heikin-Ashi Candlestick – DailyFX

Stay in Strong Trends with the Heikin-Ashi Candlestick.

Posted: Wed, 03 Sep 2014 07:00:00 GMT [source]

As the price keeps falling, the lower wicks tend to get longer, which indicates that the price dropped but again pushed back up. Heikin Ashi candles denote the Open and Close prices leading to a smoothing effect on the price chart as well. This Japanese candlestick denotes four pieces of price data in visual forms, namely Open, Close, High, and Low. Closing candle takes any input and turs it into a candle stick chart. You can go from a regular candle chart by setting the length to 1, to heikin ashi by setting the length to 4.

What is the best strategy for Heiken Ashi?

- The Emergence of a Strong Bullish or Bearish Trend. This is the most common strategy for the Heikin-Ashi technique i.e. to identify the beginning of a strong uptrend or downward trend.

- Identify Candlesticks with No Shadows.

- Candlesticks with Small Bodies Indicate Trend Pauses or Reversals.

This strategy will signal a trend change when a candlestick closes above/below the opening price of a Heikin Ashi candle of the opposite kind. • Long down candles with little upper shadow represent strong selling pressure. Long up candles with small or no lower shadows signal strong buying pressure.

Is Heikin-Ashi lagging?

From the above formulas, it becomes clear that the current candlestick of the indicator is calculated with a delay, therefore the signals given by Heikin Ashi are of a lagging nature.

To this end, the government has rolled out a slew of stimulus measures to support growth. He advocates for a system of free trade, in which individuals and businesses are free to produce and exchange goods and services without interference from the government. The below chart displays live Candlestick chart data for Apple . Others are viewed as bullish and an indication that price may rise.

A breakout is said to occur when the price of a stock clears a particular, critical level on your trading chart. The level in question could be several things such as a support level, a resistance level, a trend line, a Fibonacci level, and so on. A hanging man candle is similar to the “hammer” candle in its appearance. Their difference can be found in what type of trend the candle follows.

#4 All trades are planned in advance to give a trader enough time to enter the market every time. Most trades are placed as pending limit orders often executed during London9s session. According to one source, VWAP was first used in 1984 by a trader at Abel Noser, a Wall Street trading firm. In many cases, the target VWAP must be reached in 20 of 30 days.

Is Heikin-Ashi accurate?

Heikin Ashi candlesticks do not show true prices.

While the traditional Japanese candlesticks are derived from the actual prices, Heikin Ashi candlesticks are NOT. Because the Heikin Ashi candlesticks are averaged, they do NOT show the exact open and close prices for a particular time period.